For the last two years, the Indiana General Assembly has attempted to stiff Indiana taxpayers with subsidizing ethanol production.

For the special interests involved, if at first you don’t succeed, keep trying.

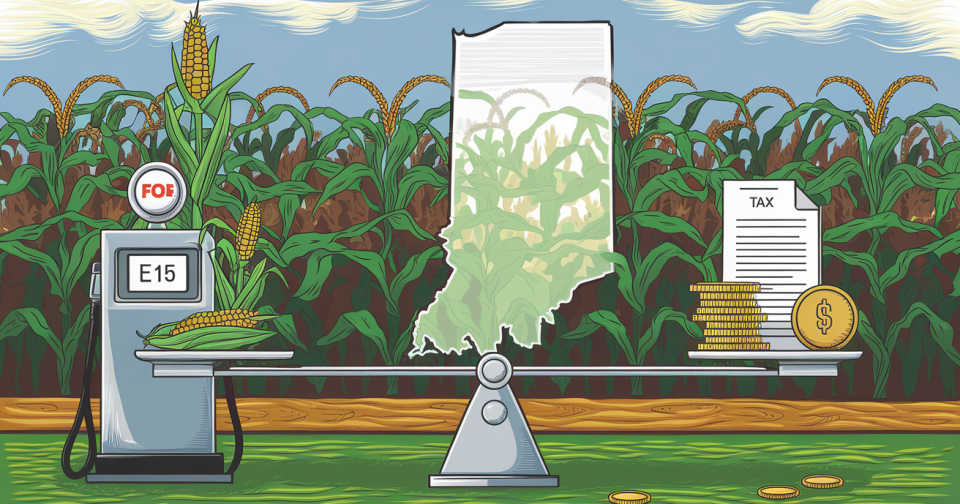

The Indiana Corn Growers Association and Indiana Soybean Alliance has been pushing for a $10 million bill that would provide tax credits to retailers selling ethanol and biofuels. State Rep. Craig Snow (R-Warsaw) has already indicated he will sponsor the bill in 2025.

During the recent Lieutenant Governor debate at the Indiana State Fair, which was sponsored by AgrIInstitute and focused on agriculture, the candidates were repeatedly asked if they would support this bill, which would give retailers five cents for each gallon of gasoline mixed with at least 15% ethanol sold at their pumps, as well as up to 18 cents per gallon of biodiesel fuels sold.

This is problematic for a number of reasons. First of all, it is a transfer of income from already-strapped Hoosier taxpayers to special interests – in this case, farmers and gas stations. While we support both the abilities of farmers and entrepreneurs to make a living, we believe in free markets.

Government should not be in the business of “directing” those markets to give favorable treatment to specific businesses. If there is enough demand for E15 – gasoline mixed with 15% ethanol, rather than the 10% currently sold at most gas pumps – consumers will buy it. They do not need government handouts to make it more favorable.

Also, Hoosiers already pay three taxes on fuels sold in Indiana – the federal and state gasoline excise taxes and the state sales tax. Combined they make Indiana the state with the fourth-highest gas taxes in the country – between 70 and 75 cents per gallon once all three taxes are factored in. Giving a tax credit and subsidy to one form of road users without reducing the already-confiscatory taxes on the majority of road users is morally wrong.

Also, only 10% of the road vehicles in Indiana are flex-fuel vehicles – which means they are able to use E85 – fuel blended with 85% ethanol and 15% gasoline. The other 90% cannot. This, however, is a push to elevate E15 (also known as Unleaded 88) fuel over regular gasoline, given most cars built after 2001 can use it.

So this will be a subsidy for a few drivers, and a government attempt to change behavior for everyone else. However, ethanol is not a panacea – it is more corrosive than regular gasoline. It also gets worse fuel mileage – ethanol’s energy content is 33% less than gasoline, and cars running E10 will get, on average, 3% worse fuel mileage than when running 100% gasoline. Increase the blend to E15, as this bill wants fuel retailers to do and motorists to buy, and any cost savings at the pump will be eaten away by having to refuel more often.

This also manipulates food prices. Already, more than 40% of the corn grown in Indiana is used in ethanol production. That means less corn is available for food. Simple supply and demand will tell us that if taxpayers are subsidizing ethanol production, more corn will be directed to it and away from Hoosiers’ tables. That creates a constraint on the supply of corn available for food, which will raise the prices at grocery stores for everyday Hoosiers.

The market, guided by the invisible hand of supply and demand, will determine what is the best use for the 5.5 million acres of corn produced every year in Indiana. Government should not be manipulating that market by trying to force market acceptance or diverting funds from taxpayers to special interest groups, while also raising our food prices.

When this bill is introduced in 2025, it should be treated as it has been the last two years by the General Assembly and voted down.

In Liberty,

Evan McMahon, Chair

Libertarian Party of Indiana